I. Introduction

On August 31, 2023, the Ministry of Economy, Trade and Industry formulated and announced the Guidelines for Corporate Takeovers (the "Guidelines").1 The Guidelines clearly state that the economy of Japan is aiming to have a soundly functioning market in acquisitions involving the transfer of corporate control and welcomes active acquisitions that contribute both in enhancing corporate value and securing the interests of shareholders. The Guidelines also aim to meet the expectations of domestic and foreign stakeholders, including investors active in international markets. The purpose of the Guidelines is to present principles and best practices that should be shared in the economy to develop fair rules for acquisitions, with a focus on how parties should behave in the context of acquiring corporate control of a listed company. While the Guidelines are not legally binding, referring to and taking action based on the best practices presented therein would likely reduce the risk of directors breaching their duties of care and loyalty, and courts will likely respect the transaction terms agreed upon between the parties more.

This article has been divided into two parts. Part I discusses the scope, basic principles, and perspectives of the Guidelines as well as the code of conduct that directors and the board of directors must observe concerning acquisitions. Part II in the next newsletter will cover increased transparency of acquisitions and takeover response policies and countermeasures.

II. Scope of the Guidelines

The Guidelines primarily address transactions where the purchaser obtains corporate control of a listed company by acquiring its shares, regardless of whether the offer or bid is solicited or unsolicited. Concerning the structure of the acquisition, the Guidelines focus on cases where the shares of the target company are acquired through tender offers, open-market purchases, or negotiated transactions, in each case, for cash consideration. However, the Guidelines may also apply to cases where corporate control is acquired through stock for stock acquisitions or through organizational restructurings, such as mergers, share exchanges, and share deliveries.

III. Principles and Basic Perspectives

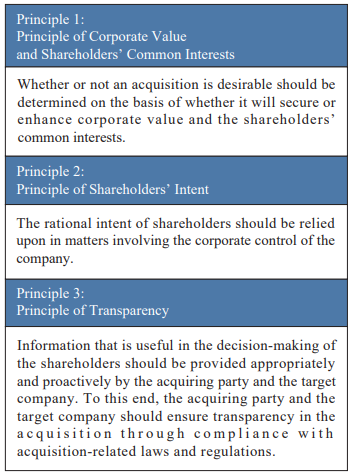

The Guidelines present the following three principles that should generally be respected in acquisitions of corporate control of listed companies:

IV. Code of Conduct for the Directors and Board of Directors on Acquisition Proposals

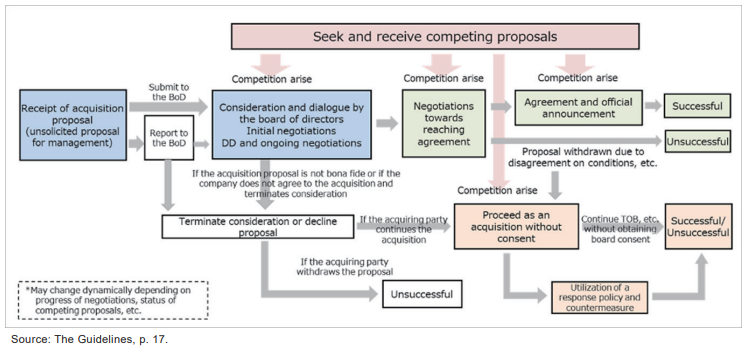

The Guidelines provide a phase-based approach to the code of conduct for each director and the board of directors for proposals that seek to acquire corporate control.

An example of the flow of issues to be considered in connection with an acquisition proposal is illustrated below:

In principle, upon receipt of an acquisition proposal to acquire corporate control, the management or directors should promptly submit or report this to the board of directors.

Whether or not an acquisition proposal should be submitted to the board of directors should be judged formally and objectively, and one of the important factors in determining this is whether the proposal is sufficiently specific, such as when the proposal is in written rather than in oral form, identifies the acquiring party rather than being anonymous, and includes the purchase price and timing of the acquisition.

The board of directors to which the matter is submitted shall in general give "sincere consideration" to a "bona fide offer" an acquisition proposal that is specific, has a rationale purpose, and is feasible. The board of directors should consider the appropriateness of the acquisition from the perspective of whether the acquisition will contribute to enhancing the corporate value, with a focus on the post-acquisition management strategy; the appropriateness of the purchase price and other transaction terms; the acquiring party's financial resources, track record and management capabilities; and the feasibility of successful completion of the acquisition.

2. When the Board of Directors Decides on a Direction toward Reaching an Agreement on an Acquisition

What is important for shareholders in terms of differences in the acquisition ratio and acquisition consideration?

(a) In case of an all-cash, full acquisition: the appropriateness of the transaction terms in terms of the price;

(b) In case of a partial acquisition: information on post-acquisition measures to enhance corporate value; and

(c) In cases where all or part of the consideration for the acquisition is shares: information on the corporate value enhancement measures and the appropriateness of the consideration (information on shares to be used as consideration and whether the market valuation thereof is appropriate).

When the board of directors decides on a direction toward reaching an agreement on an acquisition, it should negotiate diligently with the acquiring party with the aim of improving the transaction terms so that the acquisition is conducted on the best available transaction terms for the shareholders.

3. Ensuring Fairness Supplementary Functions of the Special Committee and Matters to be Noted

The necessity of establishing a special committee should be considered on a case-by-case basis, depending on the degree of conflict of interest, the need to supplement the independence of the board of directors, and the need to provide an explanation to the market. Particularly in companies where the majority of the board of directors is not composed of outside directors, establishing a special committee and respecting its judgment may be beneficial. For example, a special committee is useful in the following scenarios:

(a) When the appropriateness of the transaction terms is considered particularly important to the interest of the shareholders because the proposal includes a cash-out;

(b) When considering takeover response policies or countermeasures; and

(c) Other cases where accountability to the market is considered important (e.g., when there are multiple publicly known acquisition proposals).

The special committee should basically be composed of outside directors, given that outside directors: (a) have legal duties and responsibilities to the company, (b) are expected to be directly involved in management decisions as members of the board of directors, and (c) have a certain level of knowledge of the target company's business. In cases where the outside directors lack expertise in acquisitions, one approach is to retain advisors that will provide professional advice to the outside directors, as well as try to improve their familiarity with acquisitions.

Conclusion

The Guidelines present three principles and basic perspectives and state that, through the reasonable actions of acquirers, target companies and shareholders in acquisition transactions, and to generate value through synergy, improve management efficiency, and function as a discipline for the management team, it is necessary to adhere to a code of conduct. Under such framework, the code of conduct for directors and boards of directors for proposals to acquire corporate control outlined in the Guidelines responds to a recognition that legal precedent may not be entirely clear, and there may not necessarily be a sufficient shared understanding in practice about the actions to be taken. Nevertheless, the code of conduct is expected to be refined and clarified through future practice.

To view all formatting for this article (eg, tables, footnotes), please access the original

https://www.ohebashi.com/jp/newsletter/NL_en_2023winter_Ogata.pdf