Luxembourg is the largest centre for funds in the world outside the United States (U.S.). The country offers much for Australian PE investors. We look at what makes it so attractive.

The Grand Duchy of Luxembourg is a small country landlocked by France, Germany and Belgium. It is also a financial powerhouse, enjoying its status as a major financial centre in Europe. Luxembourg is the largest centre for funds in the World outside the U.S.

Luxembourg is gearing up to position itself as the gateway to Europe according to Angela Lai, Head of APAC and Valuations, Research Insights, Prequin at a recent roadshow organised by the Association of the Luxembourg Fund Industry (ALFI). In an increasingly competitive fundraising environment for alternatives "fund raisers are pitching to global investors more widely than ever before".

Luxembourg funds are recognised schemes worldwide and in particular in Japan, Singapore and Hong-Kong, who continue to allow Luxembourg regulated funds to be distributed on their shores. According to Preqin, Asia-focused funds made up 12 percent of Luxembourg-domiciled closes in 2021, as investors from the region became more open to the country as a base, despite the overall slowdown in Asia fundraising last year. Fund managers said the high quality of service providers – law firms, advisors, banks, administrators – in Luxembourg made setting up and managing a fund there almost effortless.

According to a recent report, the proportion of funds domiciled in Luxembourg has more than doubled in recent years, from 21 percent of new Europe-focused fund closes in 2017 to 49 percent in 2022.

During the same period, funds domiciled in the United Kingdom (UK) made up 11 per cent of the total, down from 22 per cent, partly due to the loss of passporting rights following the UK's departure from the European Union (EU).

So what is it about Luxembourg that makes it so attractive to private capital?

Investment funds

Luxembourg has decades of experience in the investment management industry and has been a leader on all major European initiatives in this area. It has however, also a strong record of innovation and experimentation in response to such developments with investment vehicles spanning a variety of different regulatory and tax regimes.

The Luxembourg Special Limited Partnership (SLP) was created in 2013 to allow capital account treatment of partnership investors in Luxembourg, thereby adding Luxembourg, and the EU itself, to the menu of jurisdictions where partnerships are available to private fund investors and sponsors.

The Reserved Alternative Investment Fund (RAIF) (1) was established in 2016 to provide a fund that brings together the tax and legal features of the existing regime of the Specialised Investment Fund (SIF) (2) in an unregulated fund. It does away with the need for approval and oversight by the Luxembourg regulator, the Commission de Surveillance du Secteur Financier (CSSF).

A new European legal development represents a big opportunity for the Luxembourg jurisdiction: the revised European Long-term Investment Fund (ELTIF). ELTIF (3) is a type of collective investment vehicle allowing investors to invest money into companies / projects in need of long-term capital. It is targeted to investment fund managers aiming at offering long-term investment opportunities to institutional and private investors across Europe.

A typical investment area of this kind of fund is infrastructure. ELTIF is designed to develop the non-bank finance market for the European real economy investments. This regulation has been recently revised, as per the publication (4) in the Official Journal of the European Union. The new rules entered into force on 9 April 2023 and will apply from 10 January 2024. The new changes, which are designed to introduce greater flexibility into the existing legal framework, are listed below (5).

Regulatory

Luxembourg is a recognised jurisdiction in Hong-Kong which considers management companies established in Luxembourg to be subject to an acceptable inspection regime. Similarly, the regulatory authorities in Singapore and other APAC jurisdictions recognise Luxembourg actors as suitably supervised for providing services on their shores, which facilitates the placement of Luxembourg products or services in APAC.

Luxembourg funds may fall into the category of either Undertaking of Collective Investment of Transferrable Securities (UCITS) or Alternative Investment Funds (AIFs). These funds can make use of "product passporting" which means that they can be marketed to investors across the EU and the European Economic Area (EAA). Funds that do not benefit from passporting need to comply with the target country's own private placement regimes.

A non-EU fund manager can either set up shop in Luxembourg and apply to be authorised as an AIFM with the CSSF or engage a third-party AIFM which would undertake the risk management functions whilst permitting the fund manager to continue to perform the portfolio management and investment function.

Tax

Luxembourg has a favourable tax regime which encourages investment, as set out in the infographics above. There is no withholding tax on interest and royalties and there are significant exemptions on dividend income, distributions and capital gains.

In addition, Luxembourg has only minimal stamp or registration duties, and no transfer taxes. Standard VAT (if applicable) is the lowest in the EU. Luxembourg also does not apply taxes on financial transactions. Partnerships are not subject to withholding tax or other direct taxes in Luxembourg, and may be considered fully transparent for tax purposes.

Distributions from Luxembourg partnerships can be treated by tax authorities in APAC as any other foreign partnership, which can have the advantage of capital account treatment. Luxembourg has also a favourable carried interest scheme tax framework (for further details please see below (6)).

Corporate

Corporates benefit from Luxembourg's business-oriented governance framework and the ease and rapidity of being able to create corporate structures from scratch. Companies and partnerships benefit from a flexible legal framework designed to foster innovation and creativity.

Local supporting ecosystem

Luxembourg is able to attract talent from all of our the world and hence, can offer a highly specialised, multi-lingual workforce to support all kinds of investment fund projects.

In addition, it is fortunate to have strong professional associations which are very active in making themselves heard vis-a-vis the Luxembourg regulators, as evidenced by a new draft law on the modernization of the investment fund sector. They are also members in international organisations with the aim of promoting the attractiveness of Luxembourg as an investment hub.

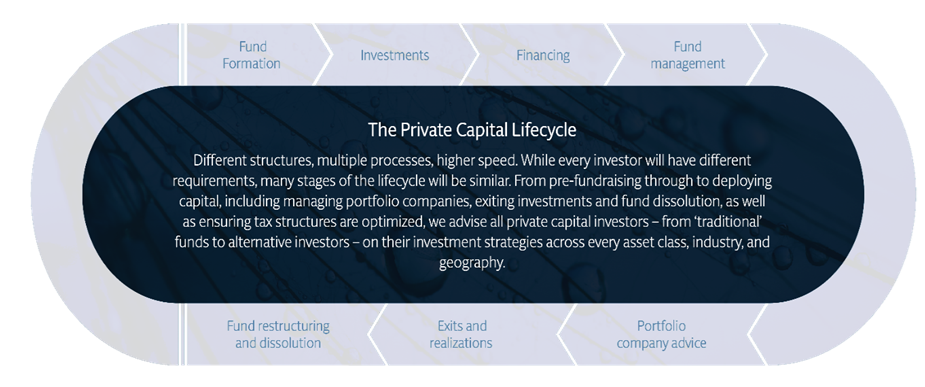

Hogan Lovells has a wide network of professionals who can advise you on your projects at all stages of the fund life cycle, should you choose to make Luxembourg your next investment destination.

(1) https://www.engage.hoganlovells.com/knowledgeservices/attachment_dw.action?attkey=FRbANEucS95NMLRN47z%2BeeOgEFCt8EGQJsWJiCH2WAUTleh6%2BAJHrqcqf8JDbpQ3&nav=FRbANEucS95NMLRN47z%2BeeOgEFCt8EGQbuwypnpZjc4%3D&attdocparam=pB7HEsg%2FZ312Bk8OIuOIH1c%2BY4beLEAei36toCI7UKE%3D&fromContentView=1

(2) https://www.engage.hoganlovells.com/knowledgeservices/attachment_dw.action?attkey=FRbANEucS95NMLRN47z%2BeeOgEFCt8EGQJsWJiCH2WAUTleh6%2BAJHrql4qJOFaqaf&nav=FRbANEucS95NMLRN47z%2BeeOgEFCt8EGQbuwypnpZjc4%3D&attdocparam=pB7HEsg%2FZ312Bk8OIuOIH1c%2BY4beLEAekechjXPmRyE%3D&fromContentView=1

(3) https://ec.europa.eu/commission/presscorner/detail/en/memo_15_4423

(4) https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32023R0606&from=IT

(5) https://www.linkedin.com/posts/hogan-lovells-luxembourg-llp-328041b0_eltif-mifidii-luxembourg-activity-7043632823643054081-ad1L/?utm_source=share&utm_medium=member_desktop

(6) https://www.engage.hoganlovells.com/knowledgeservices/carried-interest-for-fund-managers/luxembourg