Preventive Restructuring in the Czech Republic: Model Step List

Vojtech Mlynar and Katerina Grundmanova of BADOKH describe the steps taken and timeline followed in a model preventive restructuring case under the Czech Act on Preventive Restructuring (Act No 284/2023 Coll.), as discussed in a prior Expert Focus article. Their example describes a situation in which the restructuring is largely consensual but the transactional costs would make a private arrangement and renegotiation between the parties too expensive or too difficult to achieve outside of the preventive restructuring framework.

Vojtech Mlynar

View firm profileKaterina Grundmanova

View firm profileThe Company in Distress

The Company seeking restructuring in this hypothetical example is a business corporation whose centre of main interests (COMI) is located in the Czech Republic. The Company previously raised funds through a public bond offering. The issued bonds will not mature for several more years but interest is payable monthly. The Company has positive EBITDA, but its earnings are consumed by the monthly interest payments on the issued bonds. Therefore, the Company needs to renegotiate the terms of the outstanding bonds in order to avoid impending insolvency and ensure the continuity of its (otherwise viable) business project, which will ultimately generate revenues for the full repayment of the bonds issued.

Initial Considerations

The Company must start the restructuring process well before it becomes insolvent and is unable to pass the liquidity test (see here for further discussion of the nature of this test). The Company approaches its bondholders, seeking to defer interest payments until maturity. The bondholders generally support the proposed measures and Company’s restructuring is largely consensual. However, the Company concludes that a private renegotiation is unfeasible because the Company is unable to reach a large group of small bondholders (approximately 20% of issued bonds).

Given the high quorum requirements for the bondholders’ meeting, and the considerable transactional costs, the Company decides to pursue a formal process of preventive restructuring to effect restructuring measures against all bondholders.

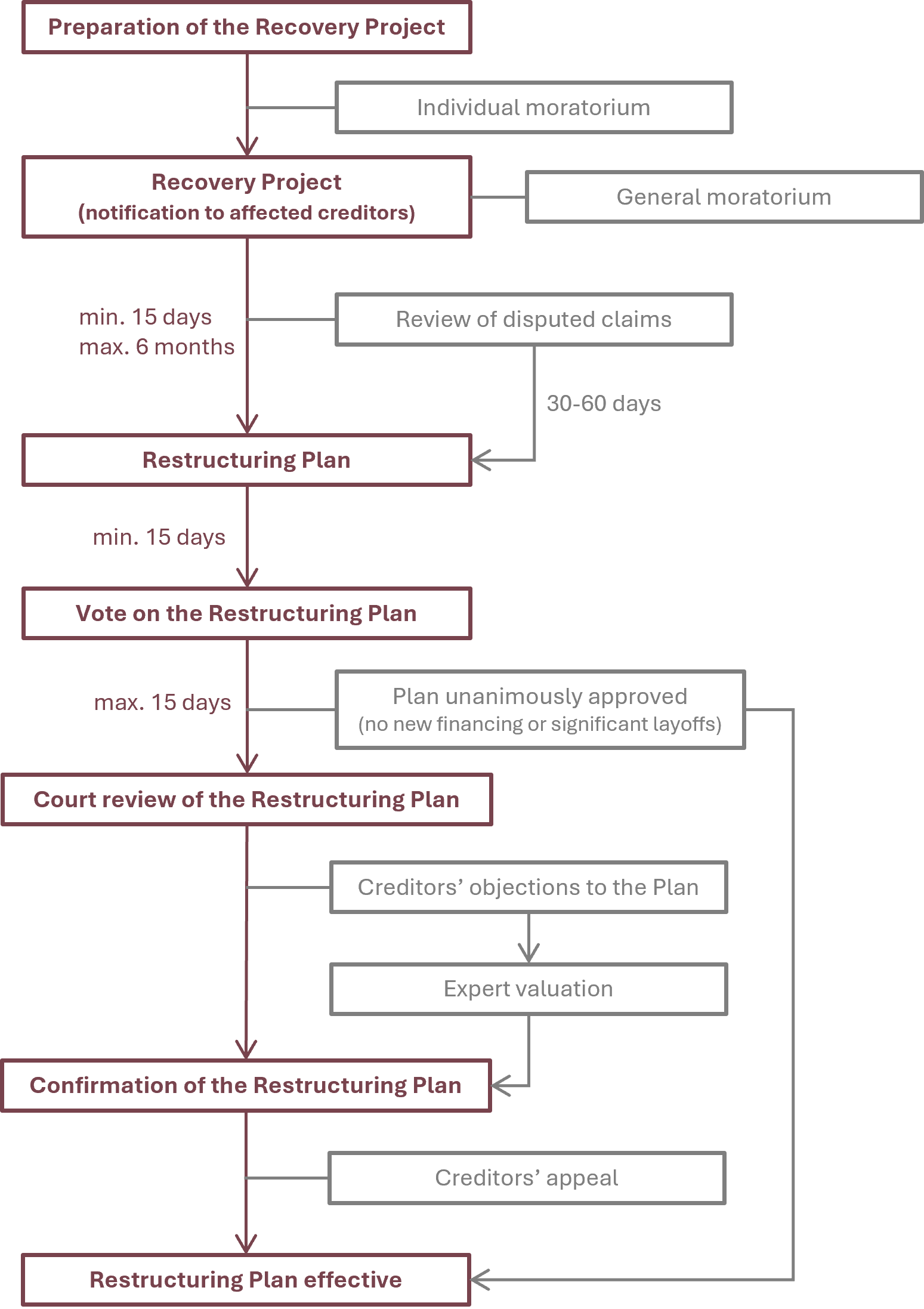

Step 1: preparation of the recovery project

The Company prepares a recovery project describing its economic situation, ownership structure, assets and liabilities, identifying the main causes of financial distress and setting out restructuring measures. The Company specifies the affected creditors and the intended effect on their rights.

All bondholders form a single class of affected creditors, and the Company proposes to defer interest payments to all of them until the bonds’ maturity.

"The Company must start the restructuring process well before it becomes insolvent and is unable to pass the liquidity test."

The Company also considers the following:

- Impact on key contractual arrangements – the initiation of preventive restructuring may constitute an event of default or breach of the Company’s warranties under existing contracts.

- Precise definition of affected creditors and affected rights – later changes to the scope and/or impact of the restructuring measures may require a restart of the restructuring process.

- Moratorium – the Company may petition the court to declare a general or individual moratorium, which may be crucial to protect the Company’s operations because the commencement of preventive restructuring does not protect the Company against an insolvency filing by creditors.

- Expert valuation – if the Company anticipates that any of its creditors may file an objection against the restructuring plan, it should prepare supporting documentation for the valuation of its business. An expert valuation is necessary for the application of a cross-class cramdown or best-interest test.

Step 2: notification to affected creditors

The Company petitions the court to publish the recovery project together with a notice to affected creditors and related documents in the restructuring register. Documents are deemed delivered to all affected creditors on the date of publication in the online register. The documents in the online register are publicly available.

Private restructuring process

To keep the restructuring process private and off the public register, the Company would have to deliver the notice to all affected creditors directly (eg, via registered mail) and be able to evidence the delivery to each affected creditor. The statutory rules do not impose a duty of confidentiality on the notified creditors.

Review of disputed claims

Affected creditors may challenge the Company’s records of their own claims or those of other creditors within 15 days from the delivery of the recovery project. If the court-appointed administrator finds the claim rightfully disputed and the restructuring court agrees, such disputed claim will be excluded from the restructuring process. Consequently, the finalisation of the restructuring plan may have to be postponed for the duration of the review period (one to two months).

Step 3: restructuring plan and creditors’ vote

The Company finalises the restructuring plan and submits the plan to the restructuring court. The plan is deemed delivered to all affected creditors upon its publication in the online register. The Company informs the creditors whether the vote on the restructuring plan will be conducted (i) at a creditors’ meeting organised by the Company, (ii) through voting ballots, or (iii) a combination of the two.

The restructuring plan is deemed approved by 75% of votes in a given creditors’ class (where creditors have one vote for every CZK1 of their claim). Only creditors who voted against the approval of the restructuring plan may file an objection or appeal against the confirmation of the restructuring plan.

Step 4: court’s review and confirmation of the restructuring plan

In this model scenario, the Company obtains 80% of the votes of affected creditors, with 78% voting for the approval of the Plan and 2% against. Since the Company has not obtained unanimous approval of the plan it has to submit a motion for court review and confirmation of the plan within 15 days from the voting deadline. Dissenting creditors may subsequently lodge their objections against the plan.

Unanimous approval of the restructuring plan

Only a unanimously approved restructuring plan may be exempt from the court’s review and becomes effective on the date of its approval by the affected creditors. Regardless of the approval in each class of affected creditors, the restructuring plan will remain subject to court’s confirmation if:

- any of the affected creditors voted against the approval of the plan;

- the restructuring measures include the provision of new financing; or

- the plan anticipates redundancies of more than 25% of a company’s employees.

Step 5: the restructuring plan becomes effective

The court confirms the plan upon satisfaction of a number of statutory conditions, including compliance with legal regulations and equal or better treatment of creditors’ claims compared to Company’s insolvency (best-interest test).

Cross-class cramdown

The court may also overrule dissenting creditor classes if the restructuring plan has been approved by at least one class of affected creditors who are unrelated to the Company.

Appeal

Only those creditors who voted against the approval of the plan and lodged a formal objection against the plan may file an appeal against the court’s confirmation of the plan. Such appeal does not have suspensive effect and the plan becomes effective upon its confirmation by the restructuring court.

Sample Timeline of the Preventive Restructuring Process

Conclusion

Preventive restructuring under the new legal framework aims to provide a fast and effective solution for distressed companies. However, any successful and effective restructuring will largely depend on the company doing diligent preparatory work, the correct identification of all affected creditors, and appropriate restructuring measures. It is thus quite possible that the application of the new framework may in practice fall considerably short of the ambitions and expectations of Czech lawmakers.

BADOKH

1 ranked department and 2 ranked lawyers

Learn more about the firm's ranking in Chambers Europe

View firm profile