Current Developments in Polish Restructuring and Insolvency Law

Paweł Kuglarz and Mateusz Kaliński of Tatara & Partners discuss the potential impact of the EU Restructuring Directive on the Polish insolvency space.

Paweł Kuglarz

Mateusz Kaliński

Data and statistics clearly show that Poland is currently undergoing an economic crisis.

The legislature should address this issue promptly together with professionals active within the restructuring and insolvency area. It goes without saying that the crisis is a test for not only the Polish economy, but also, in particular, managers and lawyers. Therefore, it is vital to have an open mind, a business-oriented approach, and tailored solutions to each specific business in distress – precisely addressing identified issues.

Implementation of the EU Restructuring Directive

Poland has yet to implement the EU Restructuring Directive (Second Chance Directive, 2019/1023). The published Directive’s implementation draft and current court inefficiency has triggered discussions about the adequacy of the court structure in Poland.

“First-instance judges must deal with both complex restructuring cases, valued at billions of Polish zloty, and simple consumer bankruptcy cases.”

The INSO Section of the Allerhand Institute took the initiative to amend the bankruptcy courts’ system.

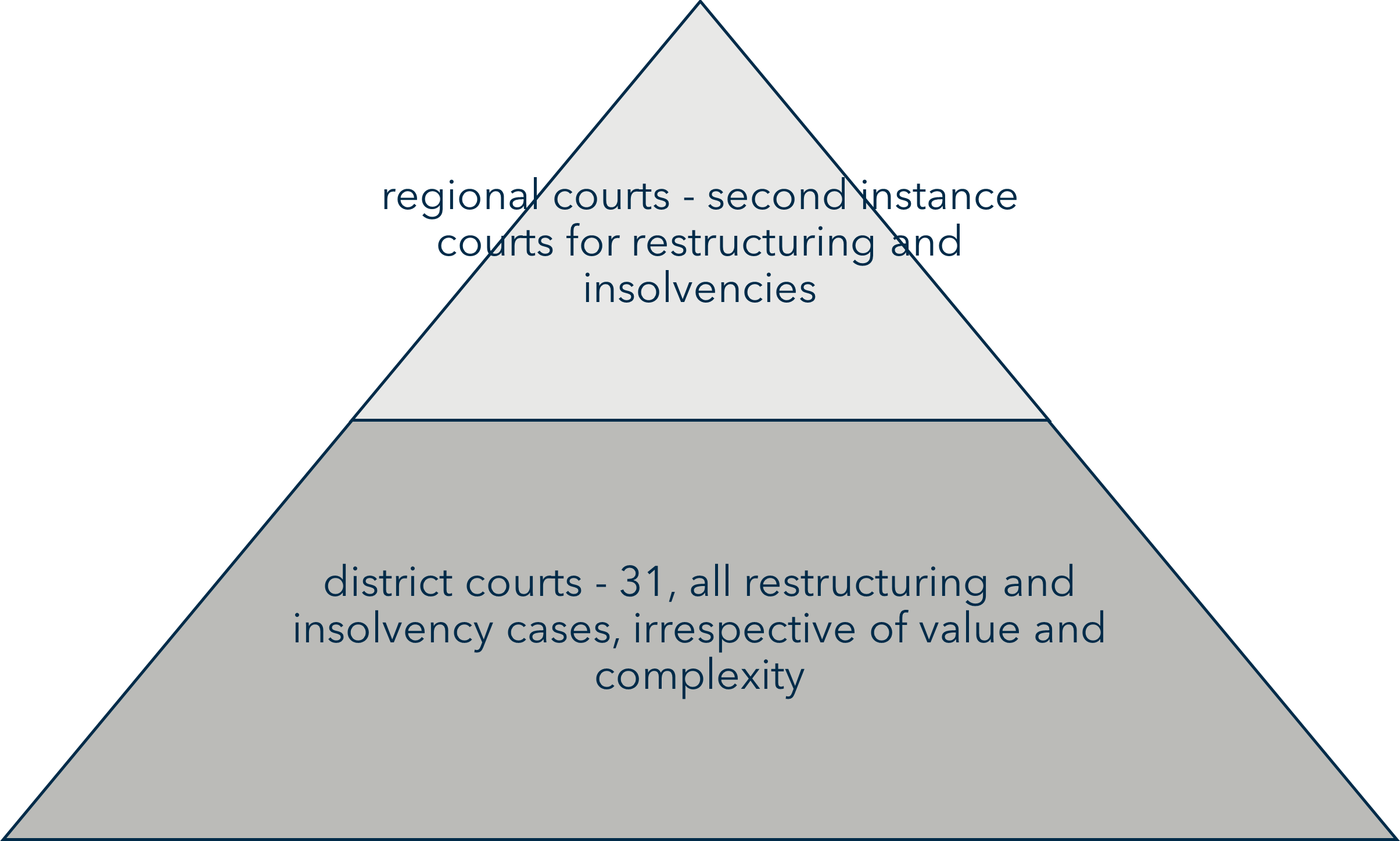

Nowadays, first instance bankruptcy and restructuring cases are processed in district courts (sądy rejonowe), which are the lowest level of Polish courts, irrespective of the value of the case and its complexity. Therefore, a first-instance judge has to deal with both complex restructuring cases valued at billions of Polish zloty and simple consumer bankruptcy cases of relatively small value. The workload is overwhelming. First-instance judges are dealing with approximately 200 consumer bankruptcy cases and ten corporate restructuring cases at the same time – an untenable work load.

The structure can be presented as follows:

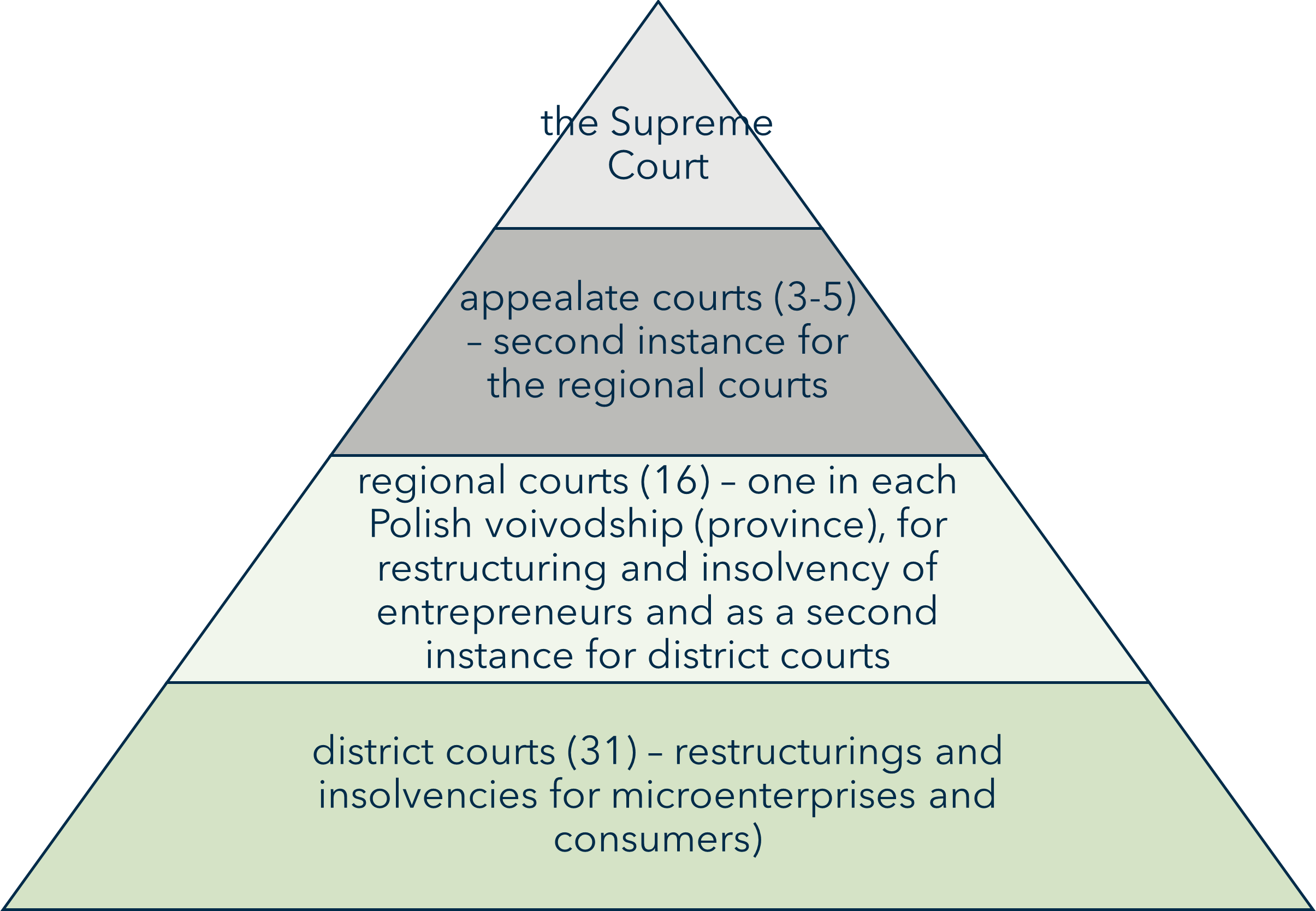

A better system would leave consumer bankruptcy cases at the district court level, so that individuals would have easy access to justice, whereas complex restructuring cases should be moved to regional courts.

The authors believe the regional courts should also become specialised second-instance courts for cases from district courts.

Moreover, cases heard in regional courts (sąd okręgowy) could be appealed in appellate courts (sądy apelacyjne), which will help to make judgements more uniform in restructuring cases. Currently Poland struggles with differing judgements in similar cases, which is a pitfall that needs to be addressed.

“Following the 2020 reform, the number of pre-pack proceedings has decreased significantly.”

There is also a need to create a special chamber or unit with the Supreme Court (Sąd Najwyższy), which would be responsible for restructuring and insolvency cases.

After the proposed reform, the system would look like:

In the authors’ opinion, this reform complies with the requirements set forth in the Restructuring Directive.

A Proposal for a Directive Harmonising Insolvency Law in the EU

The European Commission, in December 2022, published a Proposal for a Directive of the European Parliament and of the Council harmonising certain aspects of insolvency law.

Hence, yet another reform challenge is looming for Polish legislators.

Acting on behalf of the INSO Section of the Allerhand Institute, the authors have submitted a position paper commenting on the proposed amendments.

The proposal covers the following areas:

- avoidance actions;

- the tracing of assets belonging to the insolvency estate;

- pre-pack proceedings;

- the duty of directors to submit a request for the opening of insolvency proceedings;

- simplified winding-up proceedings for microenterprises;

- creditors’ committees; and

- the drawing-up of a key information factsheet by Member States on certain elements of their national law on insolvency proceedings.

It is worth mentioning, however, that most of the proposed changes are already operational within the Polish restructuring and insolvency legislative framework, and hence only minor changes will be required to comply with the new law.

The issue that raises the most questions is the simplified procedure to wind-up microenterprises.

The Proposal’s Amendments to the Pre-pack Procedure

In the section on pre-pack proceedings, the proposal provides, among other things, for the appointment of a special, independent body (the so-called monitor) to evaluate the pre-pack procedure and its benefits to creditors. It is envisaged that this body may act in the capacity of a bankruptcy trustee and at the same time be a party to the pre-pack transaction concluded with the investor. In Poland, the temporary court supervisor (tymczasowy nadzorca sądowy) could easily perform this function and would later become the trustee of the bankruptcy estate.

The proposal for the directive also provides for the preparation of a test of the best satisfaction of creditors as a basis for evaluating the price proposed by the investor.

Such a test is also postulated in Directive 2019/1023 and could be standardised, for example, in the practice of drafters, so as to serve as the source of most reliable information for creditors.

An auction, under the supervision of the court, would also be permissible. In Poland, an auction is provided for in the currently binding legislation (starting from 2020). There are questions, however, about the efficiency of the whole procedure, as following the reform of 2020 the number of pre-pack proceedings has decreased significantly.

National Debtors’ Register

Poland has introduced a fully electronic system to record restructuring cases, known as the National Debtors Register (Krajowy Rejestr Zadłużonych). Although in theory it is universal and accessible to the world at large, there is no English-language version of the system. Therefore, the parties should engage a Polish attorney-at-law or a restructuring advisor (doradca restrukturyzacyjny).

Tatara & Partners

1 ranked department and 1 ranked lawyer

Learn more about the firm’s ranking in Chambers Europe

View firm profile